On December 30th, the Summit Forum on How CFO Talks to CEO? and How Digital Finance Boosts Enterprises’ Growth was held in Shanghai. This Summit Forum was hosted by Entrepreneur Elite (International) Club, where many distinguished guests from the industry gathered to discuss the financial problems and obstacles facing enterprises in the digital era.

Cyclone Robotics attended this forum as a leading RPA provider helping enterprises achieve the intelligent transformation in financial business. Tian Sheng, Director of Intelligent Finance from Cyclone Robotics, delivered the speech under the theme of Breakthrough in Digital and Intelligent Transformation, A New Lifestyle Driven By Technology, and shared Cyclone Robotics' experience in building a Digital and Intelligent Financial Center with the guests.

According to Tian, the traditional financial model has lagged behind amid the rapidly growing technology, and the only way out is to create a new one. For enterprises, the pipeline should be replaced with a digital and intelligent financial center.

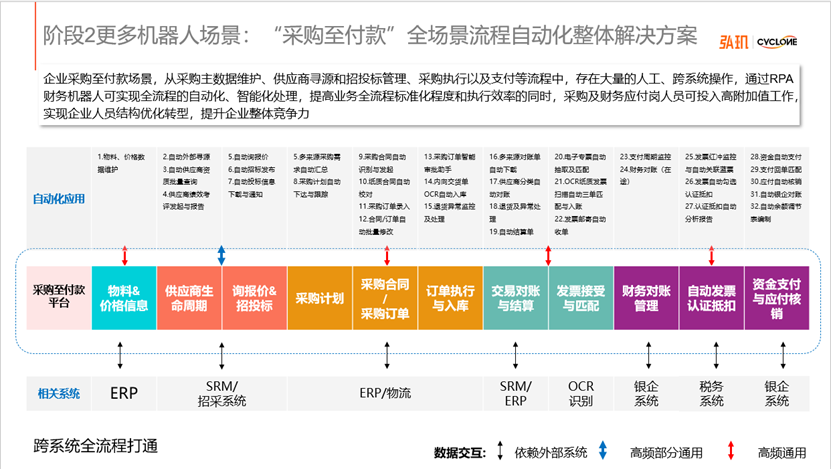

Intelligent Financial Center is a revolutionary change to the traditional financial model in Internet+ era. At its core is the digitalization of a wider range of businesses from bookkeeping and accounting to reimbursement, procurement and taxation, etc., as well as the disruptive change to enterprise financial system, business process and business model.

Digital and intelligent finance in hot demand;

Technology drives intelligent transformation in enterprises

With the demographical changes in the society, enterprises have to pay higher costs to acquire talents, so a new approach must be employed to reduce costs and increase efficiency to keep pace with the times, under the backdrop of the digital transformation.

Then, how should enterprises make a breakthrough?

At this point, we would like to talk about Cui Xiaopan, a digital employee of Vanke, who was created by technologies like Artificial Intelligence (AI) and Robotics Process Automation (RPA). Recently, Xiaopan received the Outstanding Newcomer Award of Vanke. In the eyes of most employees, she is very talented and bright, and did a good job in prepaid, receivable, and due payment bill handling, with the write-off rate reaching 91.44%.

As the core function of an enterprise, finance involves a large number of repetitive, rule-based, and low-added-value work, which cannot give full play to employees' potentials. A new vitality should be injected into the less innovative and disruptive financial business.

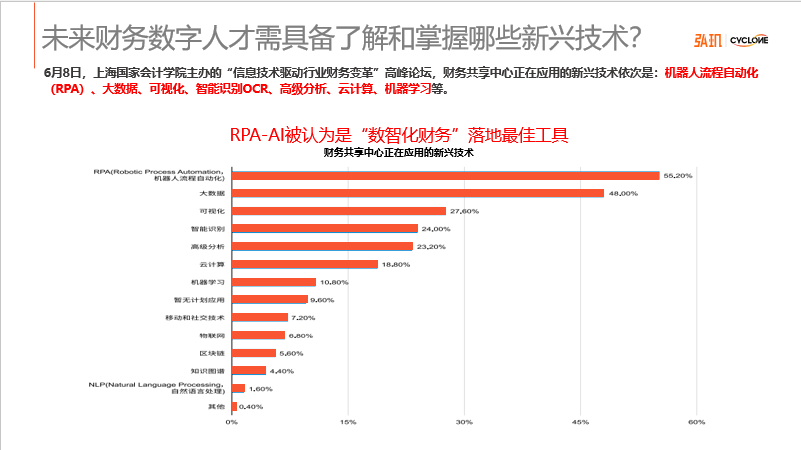

As shown in the research report on shard services in finance 2021, the top technology in the digital transformation is RPA (Robotics Process Automation). With RPA Robots, enterprises can assign the most boring work in traditional financial sharing centers to robots for automation, thus restructuring and cutting many financial processes. Employees can be emancipated from repetitive and inefficient work to create a greater value, and enhance the overall competitive power for enterprises.

Cyclone RPA + AI solution:

Improve business agility and overcome pain points in digital transformation

With its all-round intelligent automation solutions and experience in implementation, Cyclone Robotics can help enterprises develop transformation strategy tailored to their orientation in strategic positioning and the target operation mode in finance.

Tian also pointed out that enterprises should make full use of robots to help with human work, starting from those scenarios with clear rules and a large amount of tedious tasks, based on their own conditions, with the aim to build simplified, standard and intelligent business processes.

RPA + AI, as the best tool to put the digital and intelligent finance into practice, combines the intelligent financial robots and other innovative technologies to promote the development of both financial staffs and digital financial workforce. As a leading RPA provider, and the top player in Hyper Automation, Cyclone Robotics has advanced enterprise RPA products powered by AI and BI. Through these innovative combination, it can play its role in every step of enterprise automation.

Take Cyclone Intelligent Fund Robot as an example. It can help customer’s finance with several business processes like bank receipts, bank-corporate reconciliations, balance adjustments and so on, which improves the efficiency by 700+%. Another one is the Automatic Bank Revenue Verification Robot, which can reduce the time on the human work from 8 ~ 10 hours to 1 hour.

In addition, Cyclone Financial Robot can also be applied to scenarios like bank U-key management, tax declaration, intelligent form filling, intelligent reimbursement, IM approval, automatic purchase and payment, financial duty, to name just a few, overcoming pain points and making the businesses more agile and lightweight.

With the support of Cyclone Financial Robot, employees can put their focus on the work in financial data governance, financial control analysis and financial decision making. RPA helps enterprises build an innovative intelligent financial team powered by digital technologies, bridging the digital twins and creating an intelligent future together.