"Neptunus Medical Device's business department always seeks to use Cyclone Robotics' RPA when there is a new demand coming in.

中文

中文

Cyclone RPA Boosts the Business Management Capability of Jiangsu Rural Credit Union

Jiangsu Rural Credit Union (hereinafter referred to as "Jiangsu Rural Credit"), with its 6 rural commercial banks listed on the mainboard or SMEs board in China's stock market, has made Jiangsu the province the most significant number of A-share listed rural commercial banks. It is the primary force of rural finance to drive local economic development and serve the main population in communities.

In recent years, Jiangsu Rural Credit Internet Financing Platform, its acquiring services, and fast payment services have achieved rapid growth, and the acquiring merchant inspection system and the across-network acquiring risk control system have been established. However, the challenge of insufficient back-end support is becoming more prominent in the operation and management of Internet Financing platforms, which has profound impacts on the Internet Financing customers and merchants' transaction experience.

Business Pain Points

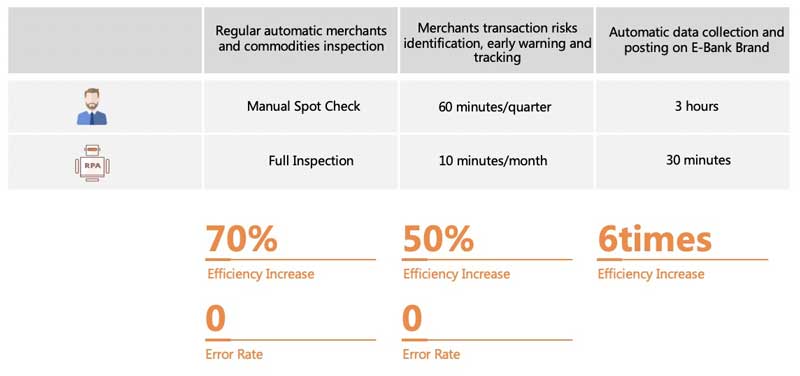

Take Jiangsu Rural Credit's regular automatic merchants and commodities inspection and merchants' transaction risks identification, early warning, and tracking for examples. In these scenarios, employees must regularly retrieve, analyze and track data from the Internet financing platform, the integrated payment system, and the merchants' risks details report to see if any non-standard abnormal data on merchants and commodities exist. Then generate the report for later maintenance and handling by relevant persons. This business poses higher requirements on data accuracy and timeliness, which may bring the business personnel more pressure at peak hours.

In addition, E-Bank Brand, Jiangsu Rural Credit's internal communication platform, also needs to collect data on weather, news, etc., from local governments and public websites. Then post it (after manual review) on its home page, local events, agricultural events, or other columns through its back-end system. Having scrutinized and analyzed these processes, Cyclone realized that they follow logical rules suitable for implementing RPA business automation.

Introducing Cyclone

Given the unique management model in the system of rural commercial banks and the future platform users' (i.e., rural commercial banks) expectations, Cyclone has designed and built Cyclone RPA intelligent automation business platform for Jiangsu Rural Credit.

With Cyclone RPA intelligent automation platform, the business user can manage agencies, users and roles, and business parameters and search in and download reports. And the O&M personnel can handle tasks like monitoring management, operations scheduling, system management, etc. In combination with traditional development technologies, the platform also enables cross-system, cross-organization data interaction and automates business processes, thus cutting labor costs and boosting business efficiency.

For example, in the regular automatic inspection of merchants and commodities, Cyclone RPA intelligent robots can first log into the Internet financing platform to obtain sensitive words. Automatically log into the Internet financing platform and the integrated payment system and carefully check merchants and commodities one by one based on the list of new and changed merchants and commodities. Then, it figures out the relevant risks and generates the inspection report based on the rules on commodities shelf-off and merchants' cancellations. After checking the above inspection report, the Jiangsu Rural Credit Union or rural commercial bank administrator may work with relevant departments or merchants to examine the risks and then take the risk control measures, such as canceling commodities and merchants.

As for the merchant transaction risks identification, early warning, and tracking, Cyclone RPA intelligent robots can automatically generate the monthly merchant inspection report, compare it with the previous month, and then produce the detailed risk data and give early warnings. The detailed risk data from the system will be analyzed and tracked at the back-end (incl. the Internet Financing Operation and Management system and the integrated payment system) and then pushed to the merchant management personnel of the rural commercial banks as per rules for further actions. The abnormal data yet to be handled within an extended period will be further examined against the previous month's report, then sent to the relevant person as a reminder. Finally, it's generated the abnormal data report.

Cyclone RPA intelligent robots can also collect data from other sources regularly and automatically post it on various columns like the home page, local events, agricultural events, etc. on E-Bank Brand through its back-end system manual review.

The Cyclone RPA business platform has transformed the traditional manual spot check in Jiangsu Rural Credit to a full inspection, thus realizing early warning of risks and more robust risk control in the overall Internet Financing businesses. And it also simplified a significant number of labor-sensitive tasks in the industries.

Data shows that the regular automatic merchants and commodities inspection sees a 70% surge in efficiency; the merchants and commodities risk identification, early warning, and tracking considers a 50% increase in efficiency; and the automatic data collection and posting on E-Bank Brand sees 6 times boost in efficiency.

Next, Cyclone RPA's intelligent automation platform will continue to work with advanced technologies like NLP, computer vision, and big data to foster organic interactions among devices, systems, and people. We are laying a solid foundation for building the financial technology ecosystem for Jiangsu Rural Credit.

-

Neptunus Medical Device

Neptunus Medical Device -

Wanda Group

Wanda GroupCyclone Robotics builds a shared RPA process automation and OCR intelligent graphic recognition platform for Wanda Group.

-

United Family

United FamilyUnited Family will continue to push forward its digital transformation efforts to solve problems brought about by complex system architectures leading to manual data uploads.

- Email us

-

(+65) 6978 5830

Working Hours 09:00 - 18:00